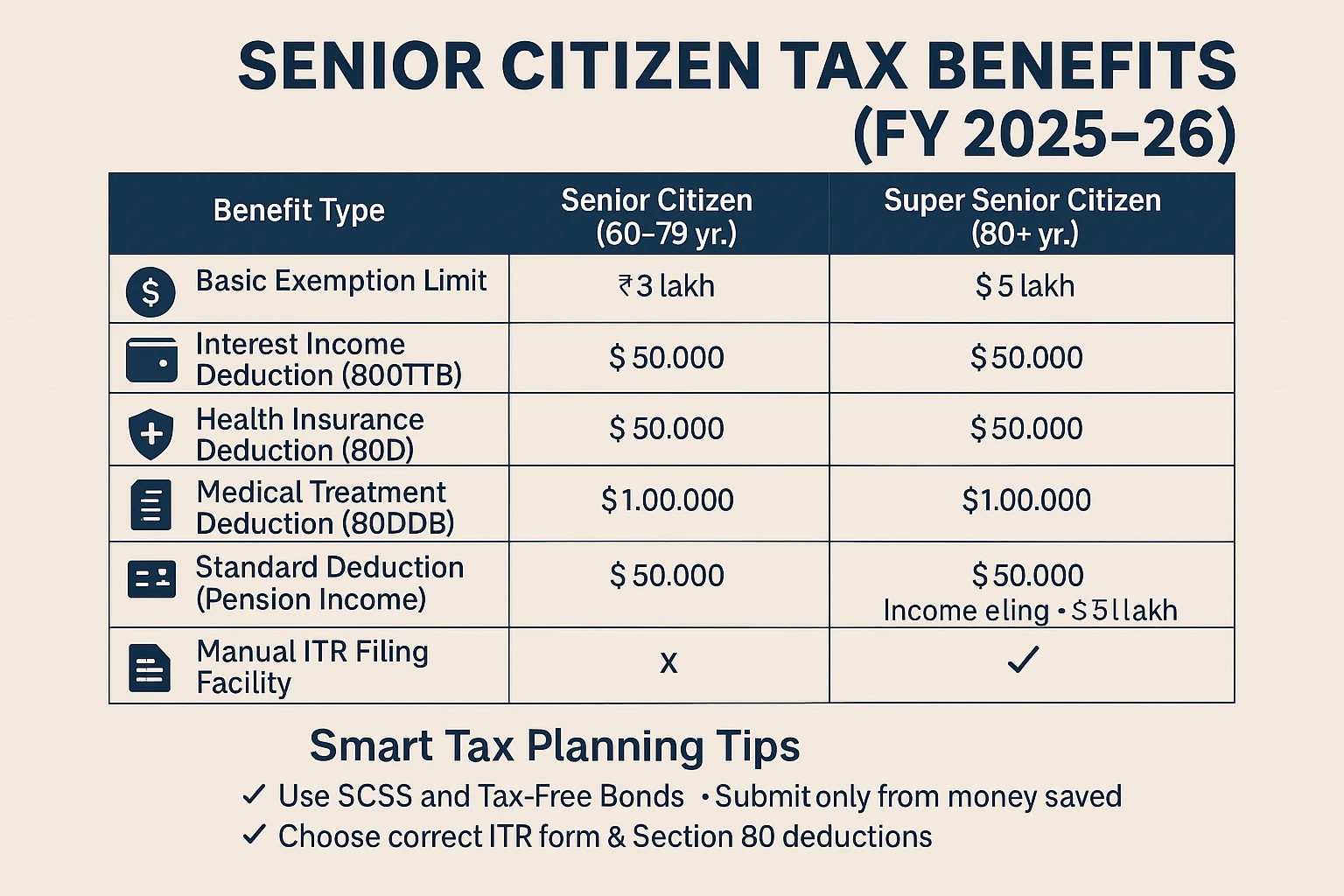

Senior Citizen Tax India: Complete Guide to Benefits, Deductions, and ITR Filing (FY 2025-26)

As individuals age, financial planning becomes crucial. The Government of India provides various income tax benefits to ease the burden on elderly taxpayers. This article is a detailed guide to understanding senior citizen tax India, highlighting exemption limits, deductions, interest income rules, pension taxability, correct ITR form selection, documentation, filing process, and FAQs. It is … Read more